mississippi state income tax calculator

If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472. Calculate your Mississippi net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4.

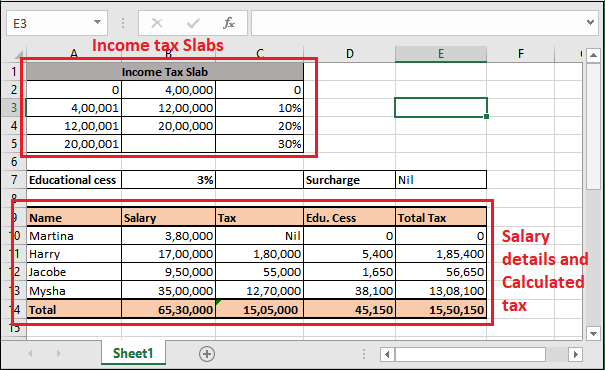

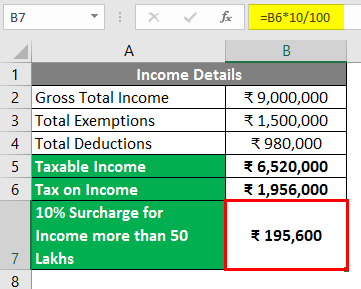

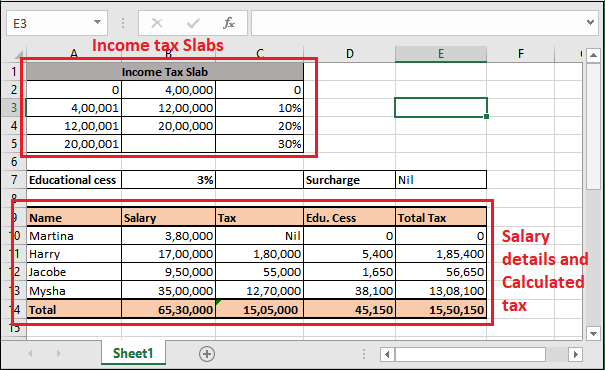

Excel Income Tax Calculator For Fy 2021 22 Ay 22 23 And Fy 22 23 Ay 23 24 Only 30 Second

Married Filing Joint or.

. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The Mississippi State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Mississippi State Tax CalculatorWe also. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

The MS Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for single joint and head of household filing in MSS. Below is listed a chart of all the exemptions allowed for Mississippi Income Tax. 94 of farm-raised catfish in the nation are raised in.

You are able to use our Mississippi State Tax Calculator to calculate your total tax costs in the tax year 202223. Mississippi State Unemployment Insurance SUI As an employer youre responsible for paying SUI remember if you pay your state unemployment tax in full and on. Just enter the five-digit zip.

Check the 2018 mississippi state tax rate and the rules to calculate. This results in roughly 9851 of. The Mississippi Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Mississippi.

Mississippi Hourly Paycheck Calculator. Enter Your Tax Information. Our income tax and paycheck calculator can help you understand your take home pay.

The Mississippi tax calculator is updated for the 202223 tax year. The Mississippi income tax calculator is designed to provide a salary example with salary deductions made in. The 2022 state personal income tax.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Mississippi state tax 6035. Ad Free Tax Calculator.

Mississippi does allow certain deduction amounts depending upon your filing status. Your average tax rate is 1198 and your marginal tax rate. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local.

Filing 5000000 of earnings will result in 178500 of your earnings being taxed as state tax calculation based on 2022 Mississippi State Tax Tables. As we discussed before Mississippi uses a graduated system to structure their state taxes. Before the official 2022 Mississippi income tax rates are released provisional 2022 tax rates are based on Mississippis 2021 income tax brackets.

See What Credits and Deductions Apply to You. There is no tax schedule for mississippi income taxes. Mississippi Salary Paycheck Calculator.

Mississippi state income tax returns for 2019 are due Monday April 15. As a resident you are required to file a state income tax return if you had any income withheld for tax purposes. The 2021 Mississippi State Income Tax Return forms for Tax Year 2021 Jan.

Your household income location filing status and number of personal exemptions. Mississippi Income Tax Calculator 2021. The tax rates are as follows.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Details on how to. The mississippi salary calculator is a good calculator for calculating your total salary deductions each year this includes federal income tax rates and thresholds in 2022 and mississippi state.

Mississippi Income Tax Forms. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Create Your Account Today to Get Started.

Mississippi State Income Tax Forms for Tax Year 2021 Jan. Mississippi Salary Tax Calculator for the Tax Year 202223. If you are receiving a refund.

0 on the first 2000 of taxable income. All other income tax returns. The Mississippi state tax rate is graduated and are the same for individual filers as well as businesses.

Select Region United States. You will be taxed 3 on any earnings between 3000. Mississippi has a population of over 2 million 2019 and is known as the catfish capital of the United States.

Mississippi state income tax. The Magnolia States tax system is progressive so taxpayers who earn more can expect to pay higher marginal rates of their income. Mississippi State Tax Quick.

The rates range from 0-5 and are based on the taxpayers adjusted gross income AGI. The state income tax rate in Mississippi is progressive and ranges from 0 to 5 while federal income tax rates range from 10 to 37 depending on your income. For an in-depth comparison try using our federal and state income tax calculator.

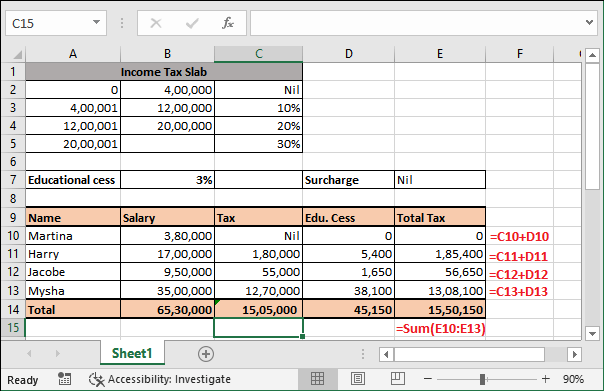

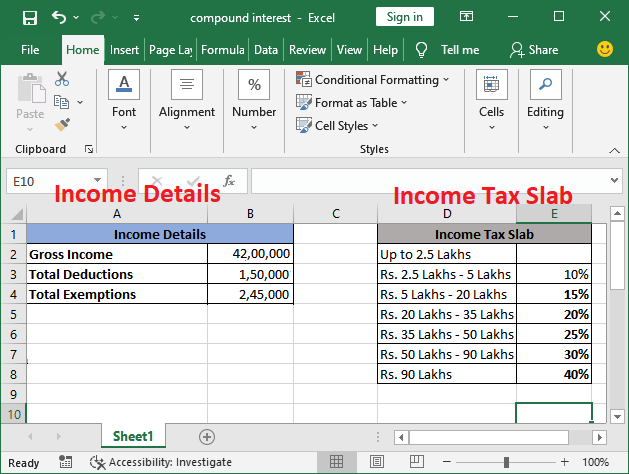

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Mississippi Income Tax Calculator Smartasset

How To Create An Income Tax Calculator In Excel Youtube

Income Tax Calculator Estimate Your Refund In Seconds For Free

Mississippi Tax Rate H R Block

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Income Tax Calculation Formula With If Statement In Excel

How To Calculate Income Tax In Excel

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Income Tax In Excel

Income Tax Calculating Formula In Excel Javatpoint

Income Tax Calculation Formula With If Statement In Excel

How To Calculate Income Tax In Excel

Income Tax Calculating Formula In Excel Javatpoint

Income Tax Calculating Formula In Excel Javatpoint

How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel